Maximize ROI: How French Crypto Mining Data Centers Offer a Competitive Edge

The allure of cryptocurrency mining continues to draw investors and tech enthusiasts alike, promising potentially lucrative returns. However, the landscape is fiercely competitive, demanding not only powerful hardware but also strategic decisions concerning operational costs, primarily electricity. This is where locations like France, with its unique energy landscape, present a compelling case for hosting mining data centers, offering a distinct competitive edge when it comes to maximizing Return on Investment (ROI).

Bitcoin, the king of cryptocurrencies, remains a primary target for miners. Its proof-of-work algorithm demands immense computational power, translating to high electricity consumption. Ethereum, before its transition to Proof of Stake, was also a major player in the mining arena, fueling the demand for robust mining infrastructure. Even Dogecoin, with its lighter algorithm, sees considerable mining activity, albeit often leveraging existing infrastructure initially designed for Bitcoin or Litecoin.

French data centers, especially those specializing in crypto mining, offer several advantages. France benefits from a diversified energy mix, including nuclear power, which provides a relatively stable and often lower cost electricity supply compared to countries heavily reliant on fossil fuels. This stability is crucial for mining operations, as consistent power is paramount for uninterrupted hashing and, consequently, continuous revenue generation.

Furthermore, France’s temperate climate can contribute to lower cooling costs. Mining rigs generate significant heat, necessitating effective cooling systems to prevent overheating and ensure optimal performance. Data centers in regions with cooler ambient temperatures require less energy-intensive cooling solutions, further reducing operational expenses. This advantage directly translates to a higher ROI for mining operations hosted within these facilities.

Mining farms are complex ecosystems, requiring not only robust hardware and cheap electricity but also sophisticated infrastructure for network connectivity, security, and maintenance. Hosting in a professionally managed data center alleviates the burden of managing these complexities in-house. These facilities offer redundant power supplies, advanced fire suppression systems, and 24/7 monitoring, minimizing downtime and maximizing uptime, crucial for continuous profitability.

The choice of cryptocurrency to mine is another key factor influencing ROI. While Bitcoin remains the dominant force, other cryptocurrencies like Litecoin, Monero, and Zcash can be profitable, especially when leveraging specialized mining hardware. The profitability of each coin is subject to market volatility, difficulty adjustments, and the efficiency of the mining rig. Miners must constantly evaluate the market and adapt their strategies to optimize their earnings.

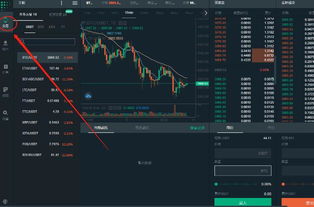

Cryptocurrency exchanges play a vital role in the mining ecosystem. They provide the platform for converting mined coins into fiat currency or other cryptocurrencies. The liquidity and security of the exchange are critical considerations for miners, as they need to be able to quickly and reliably convert their earnings. Choosing reputable exchanges with strong security protocols is essential for safeguarding mined assets.

Navigating the regulatory landscape is another crucial aspect of crypto mining. France, like many other countries, is developing its regulatory framework for cryptocurrencies and blockchain technology. Understanding and complying with these regulations is essential for ensuring the long-term viability of mining operations. Data centers that are proactive in addressing regulatory compliance offer a significant advantage to their clients.

In conclusion, maximizing ROI in cryptocurrency mining requires a multifaceted approach that encompasses hardware selection, energy efficiency, operational management, and regulatory compliance. French crypto mining data centers offer a compelling value proposition by providing access to relatively low-cost electricity, favorable climate conditions, robust infrastructure, and professional management services. By strategically leveraging these advantages, miners can significantly enhance their profitability and gain a competitive edge in the rapidly evolving world of cryptocurrency mining.

The hardware itself, the mining rig, is a critical determinant of profitability. Modern mining rigs are typically composed of Application-Specific Integrated Circuits (ASICs) for Bitcoin mining or powerful Graphics Processing Units (GPUs) for other cryptocurrencies. Selecting the right hardware that balances hashing power with energy efficiency is crucial for maximizing returns. Investing in the latest generation of mining rigs can provide a significant performance boost, but it’s essential to carefully consider the upfront costs and the expected lifespan of the equipment.

This insightful piece reveals how French crypto mining hubs leverage renewable energy and EU regulations for superior ROI, outpacing rivals—but escalating global energy costs could erode that edge.